BIFA had advised Members that at some point HMRC would require the buyer seller information to be included in a Customs declaration however, there had been an easement by which this data did not have to be included in a CDS import declaration.

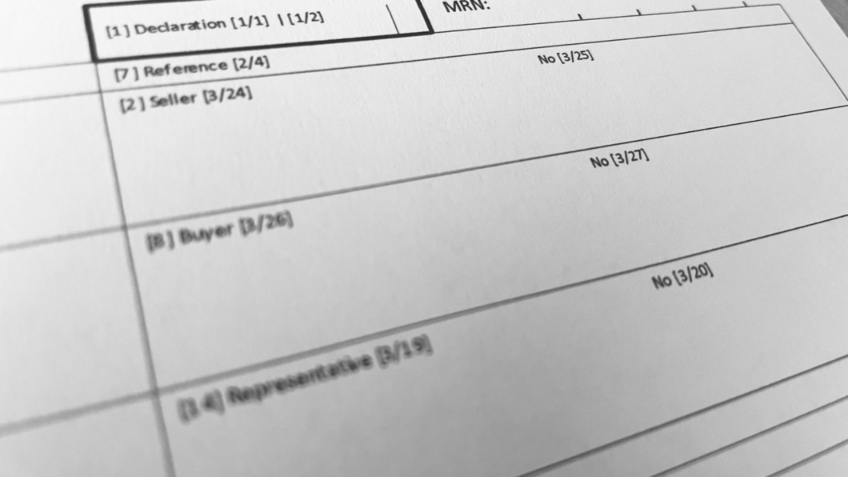

The UK Trade Tariff declaration completion guidance states that for declaration category dataset H1, where the Seller is a different party to the exporter and/or the Buyer is a different party to the importer then the Seller and/or Buyer information must be declared in DE 3/24, 3/25 and/or DE 3/26, 3/27.

As a temporary measure, HMRC had removed the requirement for declarants to provide details until 30 September 2023.

On the 18th of September, HMRC advised that the temporary Buyer and Seller easement and the temporary extension in use which were due to expire on 30 September 2023, has been extended until the current Call For Evidence on Customs Declarations has been concluded.

For more information, please see Tariff Volume 3 Great Britain Supplement CDS and CHIEF, page 28.

However, please note – Declarants should continue to hold this information, where multiple Buyers/Sellers are involved, within their own records and make available to HMRC on request.