Guest Blog Post | BIFA is cooperating with Pledge, an integrated carbon measurement and offsetting platform, to help its members better understand and address the environmental issues that affect how

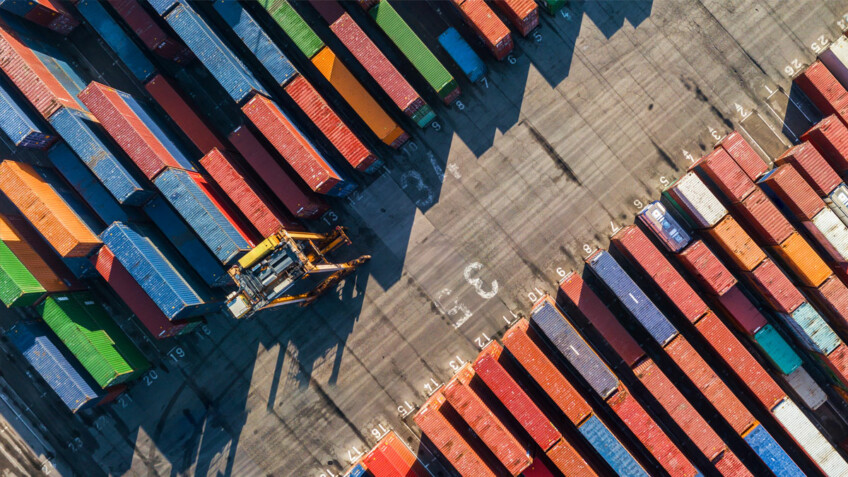

Scope 3 Emissions: A Guide For Freight Forwarders

Guest Blog Post | BIFA is cooperating with Pledge, an integrated carbon measurement and offsetting platform, to help its members better understand and address the environmental issues that affect how

HMRC has published further information related to the 999L waiver codes. The aim of this latest message is to: Please see below the message received from HMRC: Customs Declaration Service:

Following the initial information we received from Department for Business and Trade colleagues, as a result of our further engagement, additional clarification has been received in relation to a number

We have received numerous enquiries regarding the above subject and have been liaising with the UK government on behalf of Members, who are stuck in the middle between their customers

Nimble Media is delighted to announce the launch of The Big Logistics Diversity Challenge, returning once again for 2024! Specifically designed to promote the importance of equality, diversity and inclusion

Following a number of formal submissions requesting an extended transition period for the move to NCTS Phase 5 to prepare for the implementation of the new phase, HMRC has announced

The freight forwarding and shipping community of Liverpool donned their best dresses, bow ties, and dinner jackets to attend the BIFA Liverpool Region Annual Dinner on Friday 6th October at

HMRC has released guidance listing customs declaration completion requirements for goods subject to sanitary and phytosanitary (SPS) checks under the Northern Ireland Protocol. The released guidance provides information on how

Paul Cunningham has been appointed as a regional representative of BIFA – the British International Freight Association, covering its South and South West Region. Paul joins a number of other

As part of broader trade sanctions against Russia, the UK has introduced a ban on iron and steel of Russian origin. Starting from September 30th 2023, the UK will enforce

Since the UK left the EU in December 2020 the commercial operators at Dover Western Docks and Stop 24 have worked with HMRC to provide capacity for the new customs

Defra | The Expression of Interest (EoI) for the Accredited Trusted Trader Scheme (ATTS) is now live. What is ATTS? The proposed ATTS is a scheme aimed towards frequent importers