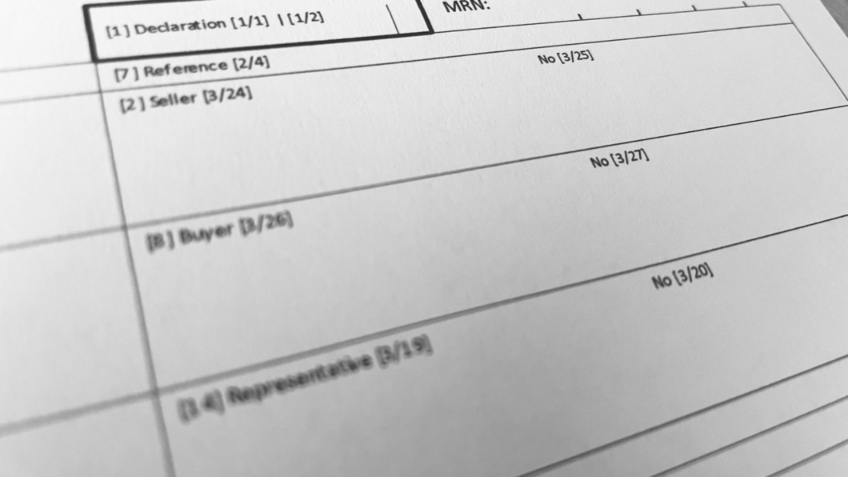

HMRC has released guidance listing customs declaration completion requirements for goods subject to sanitary and phytosanitary (SPS) checks under the Northern Ireland Protocol. The released guidance provides information on how

Customs Declaration Completion Requirements for Goods Subject to SPS Checks